Proven Strategies for Managing Debt Effectively During Furloughs

Proven Strategies for Managing Debt Effectively During Furloughs

The COVID-19 pandemic has significantly impacted the UK economy, leading to widespread furloughs and job losses in various industries. As a result, countless individuals are facing financial challenges, struggling to cope with existing debts while dealing with reduced income. If you are currently furloughed and relying on 80% of your usual salary, managing your financial obligations might feel daunting. Nevertheless, adopting a series of effective strategies can empower you to navigate these tough economic times and work towards reducing your debt burden. Here, we outline proactive measures you can take to manage your finances and pave the way for future recovery.

1. Create a Personalized Monthly Budget That Reflects Your New Financial Reality

Begin your journey towards financial stability by developing a customized monthly budget that accurately mirrors your current income situation. This budget should account for your reduced earnings, ensuring you can still save effectively. Take the opportunity to review your spending habits and identify non-essential expenditures—such as entertainment, dining out, and luxury items—that can be minimized. By prioritizing essential bills and savings while cutting back on discretionary spending, you’ll establish a sustainable financial plan that not only helps you manage your debts more effectively but also prepares you for unexpected financial challenges in the future.

2. Seek Out Alternative Income Sources to Offset Your Salary Reduction

In order to meet your debt obligations, it’s essential to find ways to compensate for the 20% reduction in salary. Look for opportunities to earn additional income through freelance work, part-time jobs, or side hustles that align with your skills. Additionally, consider trimming unnecessary expenses by canceling subscriptions you rarely use or by optimizing your grocery shopping practices. Implementing a meal plan designed to be budget-friendly can also lead to significant savings each month. By actively pursuing these extra sources of income and saving strategies, you’ll be better equipped to manage your debts and avoid falling behind while on furlough.

3. Investigate Debt Consolidation Loans to Simplify Your Financial Obligations

Consider the possibility of applying for debt consolidation loans for individuals with bad credit. These financial solutions can help streamline your payments by consolidating multiple debts into a single, easier-to-manage monthly payment. This simplification can eliminate confusion surrounding different due dates and payment amounts, significantly easing your financial planning efforts. For furloughed individuals, a <a href=”https://limitsofstrategy.com/debt-consolidation-loan-calculator-for-effective-budgeting/”>debt consolidation loan</a> can provide a structured approach to managing your limited income, reducing the stress of juggling multiple payments, and helping you regain control over your financial situation.

4. Formulate a Strategic Plan for Your Long-Term Financial Goals

As you navigate these financial obstacles, it’s crucial to keep your long-term aspirations in focus, whether that involves buying a home or starting your own enterprise. Establishing these future goals can serve as motivation to improve your financial status. Furthermore, a debt consolidation loan can contribute to enhancing your credit score, which could lead to better mortgage or business loan options with more favorable interest rates. By planning strategically and working towards your financial objectives, you set yourself on a path to success and can achieve greater financial independence down the road.

For expert guidance and additional resources on managing your finances during the pandemic, along with insights on how <a href=”https://limitsofstrategy.com/understanding-good-debt-and-bad-debt-a-clear-guide/”>debt consolidation loans</a> can assist furloughed workers, don’t hesitate to reach out to Debt Consolidation Loans today.

If you own a home or run a business, contact the experts at Debt Consolidation Loans today to learn how a debt consolidation loan can positively influence your financial health and security.

If you believe a Debt Consolidation Loan aligns with your financial goals, reach out to us or call 0333 577 5626. Take the critical first step toward enhancing your financial condition with a single, manageable monthly payment.

Discover Essential Financial Resources for Expert Guidance:

Consolidate My Medical Loan: Is It Possible?

Consolidate My Medical Loan: Is It Possible?

Can You Successfully Consolidate Your Medical Loan?

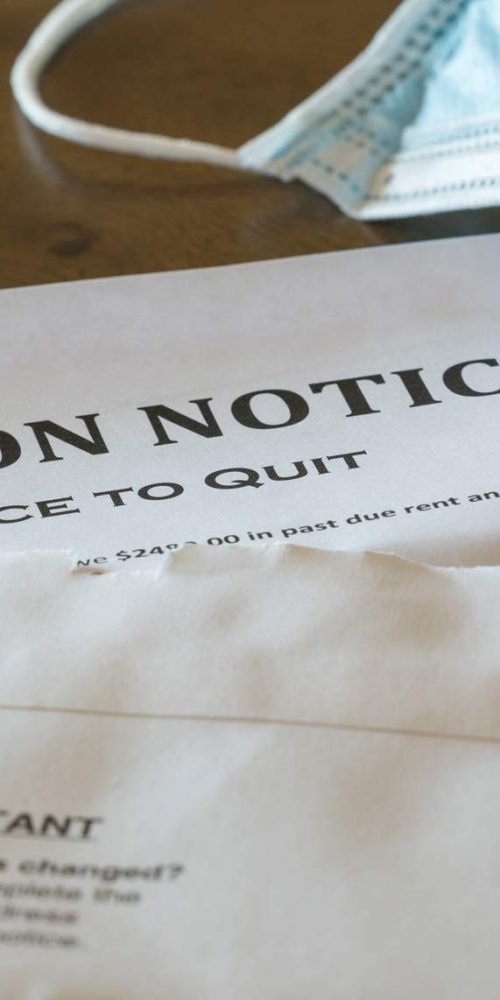

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March: Essential Information to Stay Informed

Get Out of Debt Quickly: Effective Strategies to Consider

Get Out of Debt Quickly: Effective Strategies to Consider

Proven Strategies for Quickly Reducing Your Debt Load

Debt Consolidation Loans UK: Benefits and Drawbacks

Debt Consolidation Loans UK: Benefits and Drawbacks

Understanding the Pros and Cons of Debt Consolidation Loans in the UK

Debt Consolidation Loan Calculator for Smart Financial Planning

Debt Consolidation Loan Calculator for Smart Financial Planning